Hemnet Group AB (Long Investment Thesis)

Link to memo PDF

Recommendation

Long HEM with a 3-yr price target of 212kr, representing 51% upside and 15% IRR.

Thesis Summary

Hemnet is the undisputed leader in online property portals in Sweden. Its brand and dominant market position are nearly impossible to replicate due to its 20yr+ roots with the real estate agent community. Continued expansion of its B2C (seller) and B2B (agents/other home professional) product offerings will strengthen its competitive moat, while delivering ~20% revenues growth flowing through to ~17% FCF growth.

Business Description

Hemnet—translated as "the home"—is an online residential property portal in Sweden, bringing together sellers, buyers, agents, and developers on a single platform. Sellers pay Hemnet directly to list their property, while agents receive a commission for the listing and associated add-on services. Hemnet offers agents and developers B2B products and services to enhance their brands and listings. In 2021, Hemnet's revenue mix was 67% from property listing services and 33% from other B2B and advertising services.

FY21 Results (SEK kr)

| Revenue | Adj. EBITDA | Adj. EBITDA Margin | Net Income | Net Income Margin | EPS | Dividend Yield |

|---|---|---|---|---|---|---|

| SEK 728.1m | SEK 355m | 48.8% | SEK 156.5m | 21.5% | 1.55 kr | 0.39% |

HEM SS (Mar 4, 2022 Quote)

| Price | Market Cap | Net Debt | Enterprise Value | 52-Week High | 52-Week Low | Free Float % |

|---|---|---|---|---|---|---|

| 140.40 kr | SEK 13,488.5m | SEK 188.6m | SEK 13,677.5m | 123.95 kr | 257.00 kr | 42.4% |

Valuation

| Metric | Base | Bear | Bull |

|---|---|---|---|

| 2025E Revenue | 1,774 | 1,272 | 2,291 |

| '22-'25 CAGR | 20% | 12% | 27% |

| 2025E Adj. EBITDA | 887 | 509 | 1,148 |

| 2025E Adj. EBITDA Margin | 50% | 40% | 50% |

| Target NTM EV/EBITDA Multiple | 25.0 | 20.0 | 28.0 |

| Price Target | 212 kr | 96 kr | 309 kr |

| Upside (Downside) | 51% | (31%) | 120% |

| 3-year IRR | 15% | (12%) | 30% |

Ownership

Before Hemnet's IPO in April 2021, a PE consortium (General Atlantic / Sprints) owned the business for 4.5 years. Post-IPO, General Atlantic retains a 32.4% stake, and Sprints owns 9.3%. Sweden's largest real estate agent association, Mäklarsamfundet (MSF), owns 10.5%. MSF maintains a long-term strategic agreement with Hemnet. MSF retains veto rights on major changes to business objectives, Hemnet may not become an agent or directly market mortgage services, and Hemnet must guarantee fair treatment across agencies.

Investment Thesis

1. Market underestimates the expansion of HEM's moat from new product offerings and innovation.

- Online property portals are ultimately influenced by network effects from both the seller and the buyer side. Hemnet facilitates ~90% of all Swedish residential sales, enjoys a relative market share of 12.2x (in revenues) and 10.7x monthly traffic than its #2 competitor. In Sept 2021, Hemnet is one of Sweden's top 5 media brands, only behind media giants such as Spotify, Netflix, Google, and Youtube. During COVID-19, Hemnet launched a virtual touring feature in ~10 days, displaying technological prowess to capture opportunity. Company's competitive position results from 20+ years relationship with agents and the real estate community. Ultimately, this position translates into amazing pricing power, unparalleled analytical advantage in the Swedish housing market, and a strong network reinforcing competitive moat. Pricing power is evident as average revenue per listing increased 45% (Q4 FY21), driven by doubling listing add-on uptake from ~20% to ~40% (author's proprietary data), and sequential price optimizations throughout the year.

- Sweden is an agent-mandated country, where real estate agents conduct ~96% of all residential sales. There are ~7.5k registered agents at the end of 2021, and ~7k are active users of Hemnet. As Hemnet expands its B2B offerings (such as "Hemnet Business" which is a monthly subscription) to agents to promote their individual brands and unlock market insights, agents become more dependent on the platform to facilitate each sale. As of 2021, ~85% of agents on Hemnet subscribe to "Hemnet Business". The Company is beta testing a "Pro" version for expert users in 2021 and 2022. As agents grow accustomed to running their business on Hemnet, there is an increasingly higher switching cost to any alternative.

- Listings and associated add-on services on Hemnet are paid by the property seller directly to Hemnet. However, the agent is responsible for administering the listing and running the selling process. Therefore, Hemnet pays the agent a 30% administration fee on the base listing fee and a 20-40% commission on additional listing add-on services purchased by the seller. Since 2018, Hemnet has introduced many new add-on listing services (2 new listing tiers and 2 micro-transactions to boost listing visibility), which generally increases the seller's aggregate spend on listing services. While the commissions on these sales remains fixed as a percentage, agents benefit hugely in absolute terms from increased commissions from new products and services. As new products are introduced, agents receive higher earning potential. They are more incentivized to recommend Hemnet vs. any other alternative, Hemnet's top-line growth translates into agents' top-line growth.

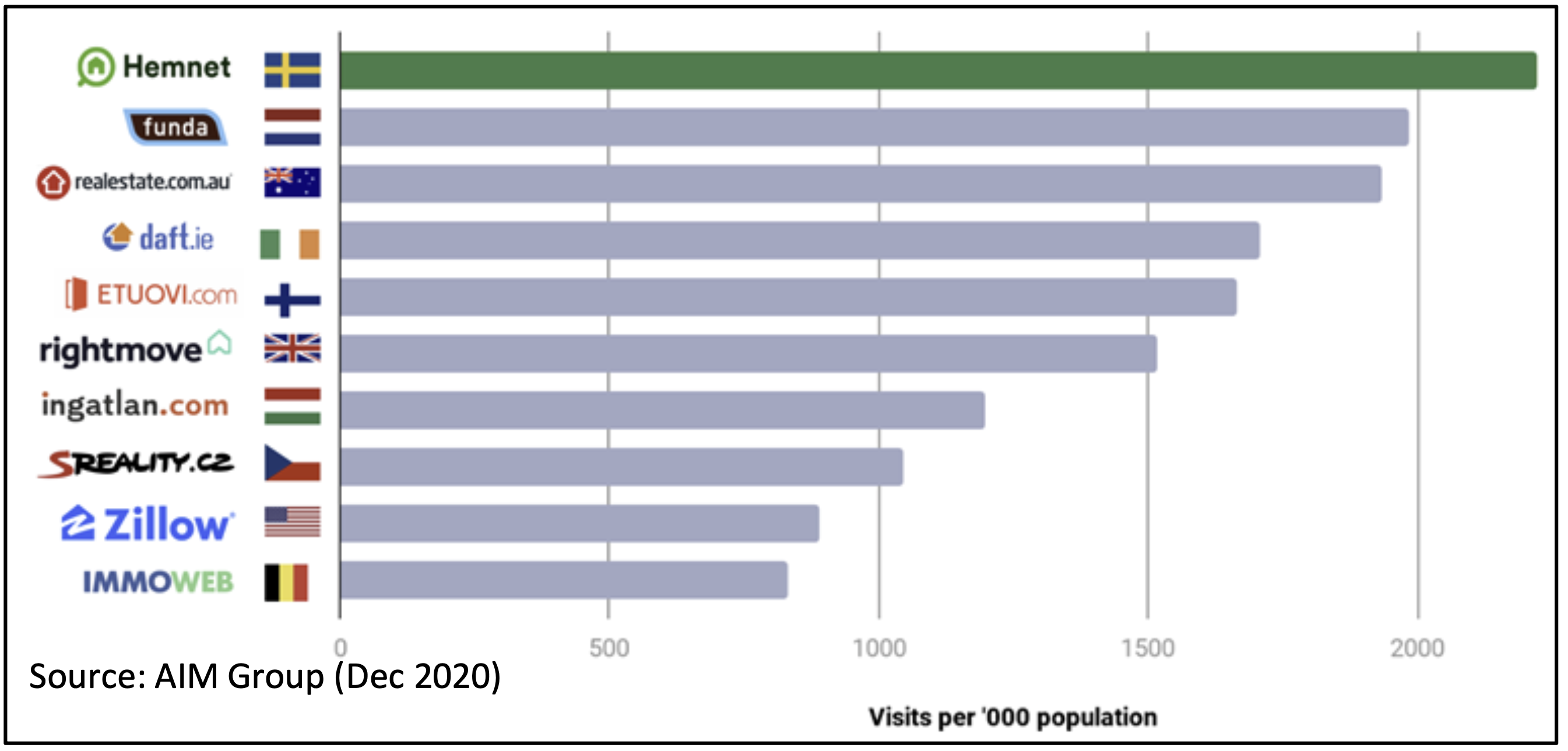

2. Market underestimates HEM's untapped optionality to monetize its 60M+ monthly visits through agent, developer, and home-adjacent advertising and integrations. Its visit per capita is highest among global property portal peers.

- TAM for expanding into home-adjacent marketing spend is estimated to be ~2.5-3.2bn SEK by 2026. This optionality is not actively incorporated by the market. It can be easily tapped by Hemnet by leveraging its existing advertising tech platform.

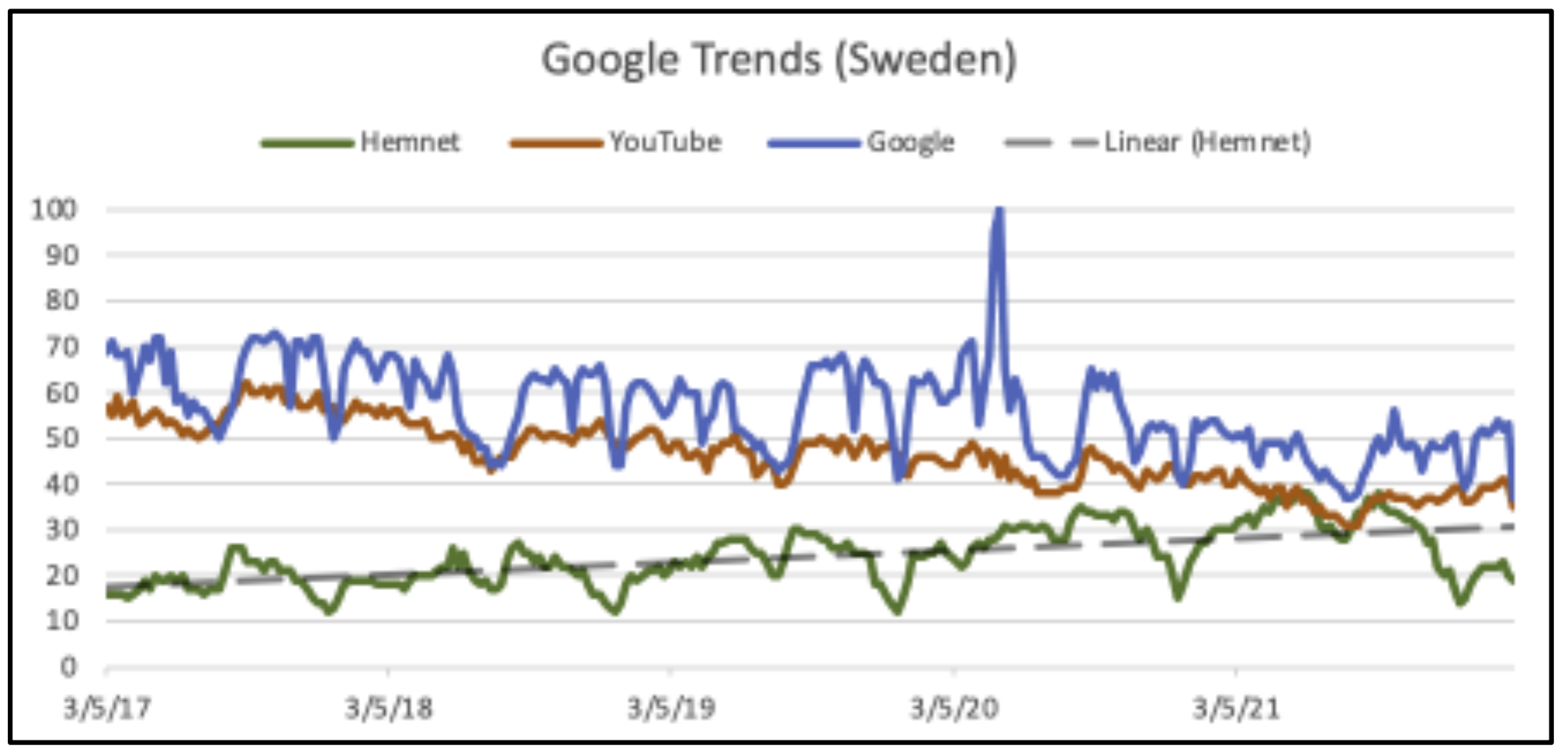

- Hemnet enjoys nearly all its website and mobile traffic substantially for free and organically. As of 2021, the Company does not regularly spend paid marketing to acquire customers to its website. According to the Company, ~50% of visitors are actively looking to purchase a home in the following months, while the remaining ~50% is someone in their journey pre/post home purchase. Its search interest relative to Google and Youtube has increased steadily since 2017 (see green line in Google Trend graph).

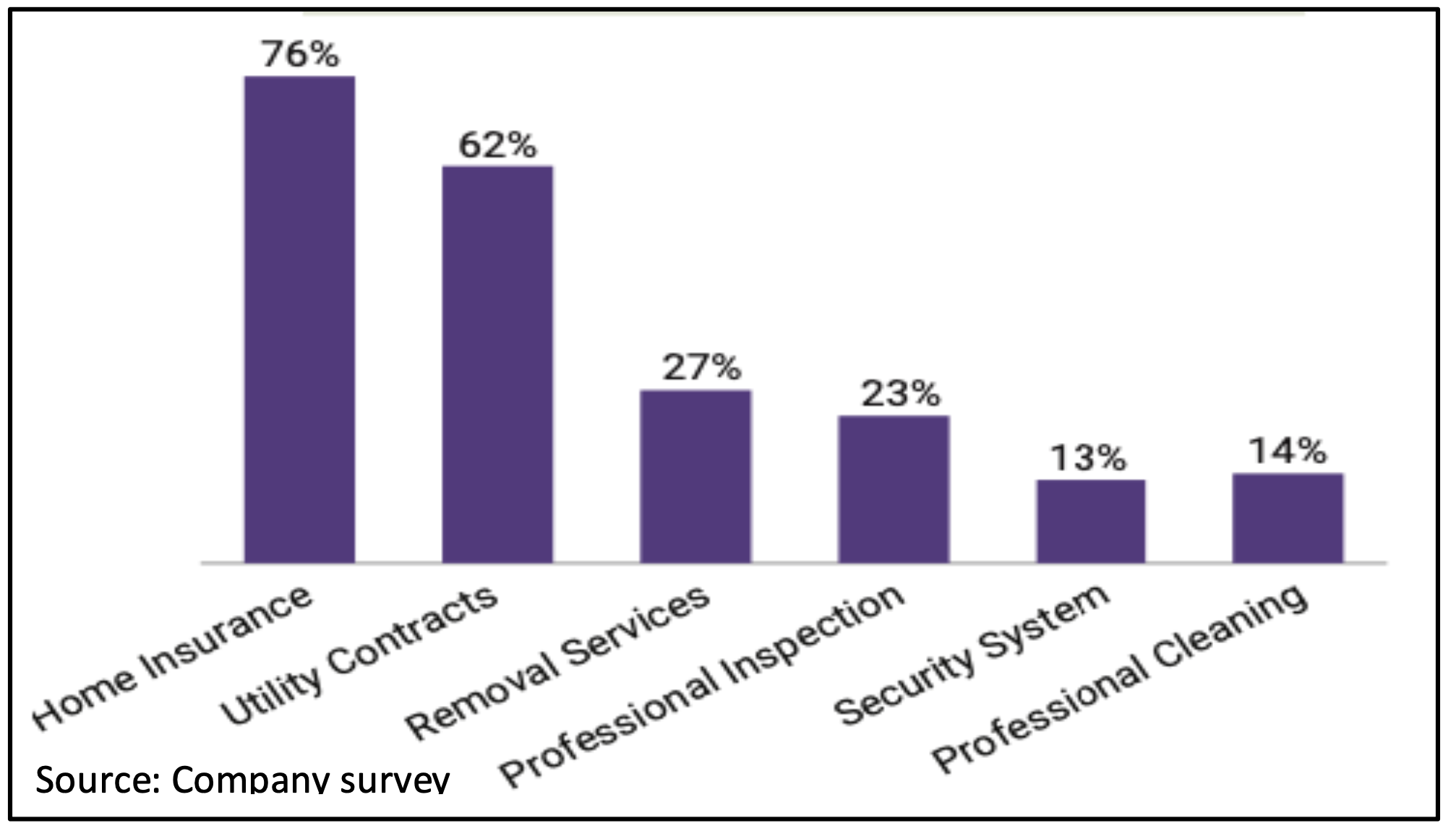

- Hemnet heavily focuses its website and mobile application on the home listing. On the listing, buyers can find links to mortgage and insurance providers, which pay Hemnet a fee for placement. However, besides mortgage services, buyers actively look for other products simultaneously, such as utility contracts, moving services, etc. (see Company survey result graph). The current media offering is rudimentary, compared to industry, and there is plenty of runway to expand formats and integrations to expand spend.

3. Strategic agreement with Mäklarsamfundet until 2045 provides a long-term relationship with real estate agents.

- Mäklarsamfundet (MSF) is Sweden's largest real estate agent association, with >80% registered agents as members. MSF was one of the original co-owners of Hemnet in 1998 with 3 other real estate players and 2 newspapers. As of 2021, MSF maintains a ~10% stake in Hemnet and a strategic agreement with veto rights on business objectives (as mentioned in the shareholder section).

- Because of Sweden's regulatory environment for real estate transactions, real estate agents are key partners for Hemnet to continue to monetize the property transaction. This long-term agreement is a lock-in to ensure agents will recommend and support Hemnet's platform for the foreseeable future.

Valuation Analysis

- Base case 25x EV/2025E EBITDA multiple, assumes multiple contraction from current cons. FY1 EV/EBITDA multiple of 29x.

- Backstopped by DCF assuming 18% revenues growth from '26-'29, 3% terminal growth post-2029 @ 7% WACC.

- Bull/Bear case represents a ~3.9 risk/reward skew. Bear case assumes rapid revenue growth deceleration to ~12% CAGR from cyclical real estate downturn, as well as multiple contraction from 29x to 20x.

- All cases do not incorporate potential approval of share buyback of up to 10% of outstanding shares, pending April 2022.

Risks

- New challenger portal "Boneo" started in 2019 by a consortium of agents: As of Dec 2021, Hemnet enjoys a 77x+ traffic advantage to Boneo, measured by Similarweb for desktop traffic. This is an underestimate without incorporating Hemnet's mobile applications, which likely means the advantage is 77-100x. In addition, 90% of all residential sales and >80% of agents continue to transact through Hemnet. Agents are the lock-in mechanism that prevent sellers taking their listing elsewhere, and Hemnet has an agreement with those 80% of agents through 2045.

- Too aggressive pricing power could hurt brand and loyalty: Hemnet leverages a multi-pronged revenue growth strategy focusing on B2C listing revenues growth through product mix/conversions improvement while introducing new value-add services with segmented price differentials. This approach decreases brand risk, as the seller gains additional value for paying a higher price. In 2021, Hemnet had a +45 NPS score, while the local peers had -37NPS.

- Anti-trust concerns from Swedish Competition Authority (SCA): In 2015, Schibsted, a Norwegian media group, attempted to purchase a controlling stake in Hemnet. However, the deal was challenged by SCA after a year of regulatory pressure and collapsed. The main concern was Schibsted's ownership in Blocket—another property platform—would have created a monopolistic position for Schibsted in Sweden. Instead, Hemnet was purchased by a PE-led consortium, which still maintains substantial ownership in Hemnet post-IPO. As a result, Hemnet is unlikely to face additional regulatory pressure unless another merger is attempted, as Swedish laws do not prohibit pricing advantages directly.